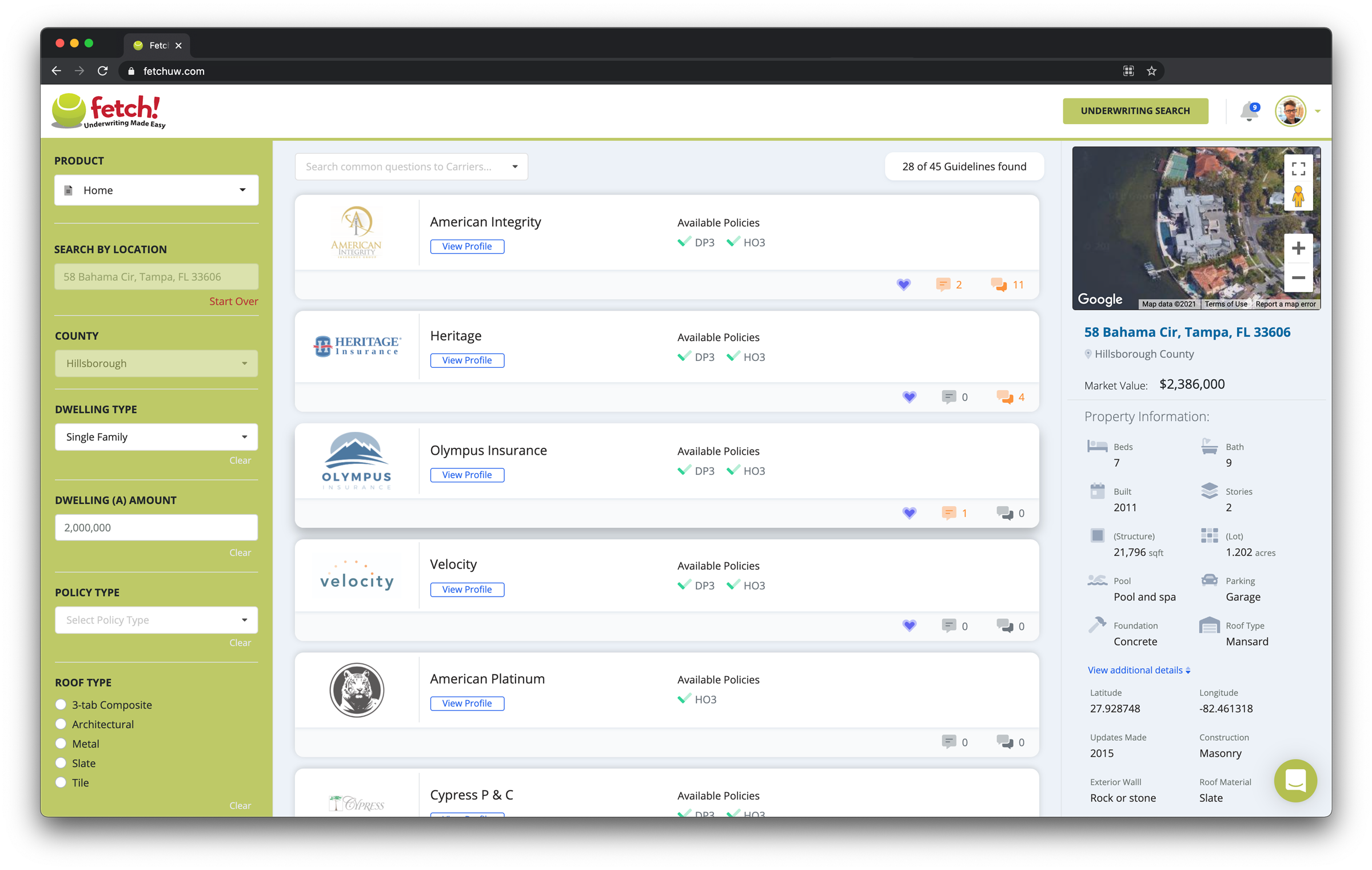

Underwriting Made Easy

The underwriting process you’ve only dreamed about. Place your risk in 30 seconds or less.

Unleash The Power of Fetch

Envoy

Fetch Envoy gives you up-to-the-minute changes in guidelines that previously you’d have to painstakingly search for on a carrier’s site

Search

No more 3-ring binders. No more excel spreadsheets. Find out who will underwrite your risk in less than 30 seconds.

Insight

Fetch Insight has the homeowner data you need to assess risk and power your underwriting. Make more informed decisions — today.

Simple pricing

Discounts available for enterprise plans.

Fetch Free

FREE

- Unlimited Address Searches

- Personal Line Filters

- Guidelines Library

- Envoy Updates

- Insight Property Data

- Appointed Carriers

- PDF Guidelines

- Team Management

- Personal & Team Notes

Fetch Pro

7 Day Free Trial

Contact Us

- Unlimited Address Searches

- Personal Line Filters

- Guidelines Library

- Envoy Updates

- Insight Property Data

- Appointed Carriers

- PDF Guidelines

- Team Management

- Personal & Team Notes

Enterprise

More than 20 users?

Contact Us

- Have a large team?

- Contact us for discounted pricing.

- All features included in Pro subscription.

Frequently Asked Questions

How often is Fetch updated?

Fetch is continuously checking for and receiving data from carriers and a select agencies. Typically, carriers publish data on different frequencies, anywhere from a couple days to annually. Once an update happens, the latest data will be found in the Fetch database within just a few days to allow for data processing.

How can I guarantee the accuracy of the data?

All data provided by Fetch comes from underwriters, guidelines, manuels, and other verified sources. The data provided will be as accurate as the original documents used for legal purposes.

Can I add additional users to my account?

Yes! All Fetch accounts come with a team option. You can add and remove as many users as you’d like.

Is there an additional cost for users on my team?

For Pro accounts, each additional users is billed at $12 per month. There is no cost for Free accounts.

How much data does Fetch have?

Fetch currently has data for Florida and Texas carriers. The total number of data points in the Fetch is over 29 billion.

When will my account be billed?

Monthly plans are billed the day you sign up and every 30 days thereafter. Annual plans are billed the day you sign up and every 365 days thereafter.

Can I change or cancel my plan?

The Pro plan listed may be cancelled at any time without penalty. Your Pro status will continue to be active until the end of the billing period. You can upgrade or downgrade your plan at any time.

How accurate is the property Insight data?

All data provided by Fetch comes from public records, legal offices, and other verified sources. The data provided will be as accurate as the original documents used for legal purposes.